Agricultural outlook for Q1 2026 from Terrain™, our service for agricultural insights. Author Matt Clark is Terrain's interim executive head. Most recently, he was Terrain’s senior rural economy analyst, focusing on the impacts of interest rates, land values and other macroeconomic trends on agriculture. This article originally appeared on TerrainAg.com.

Report Snapshot

Situation

Market expectations for further cuts to the federal funds rate were met in December as the Federal Reserve cut interest rates by 0.25%, bringing total cuts in 2025 to 0.75%.

Impact

The slight cuts in interest rates should help farmers with variable-rate loans or those pricing short-term debts.

Outlook

I expect only modest declines in short-term interest rates in 2026. Long-term interest rates may come down somewhat, but the direction of longer-term interest rates will depend heavily on the market’s expectation of future inflation, economic growth and fiscal policy.

On December 10, the Federal Reserve’s Federal Open Market Committee (FOMC) voted to cut the federal funds rate by 0.25% to a range of 3.5% to 3.75%. Overall, the FOMC has cut the federal funds rate by 0.75% in 2025.

The vote was not unanimous. One member dissented in favor of cutting further, and two members dissented in favor of no cuts. The lack of unanimity highlights the uncertainty of future cuts.

Concern over the labor market was the impetus for the consenting votes to cut interest rates. The unemployment rate rose from 4% in January to 4.6% in November, according to the Bureau of Labor Statistics. The median estimate from the FOMC’s Summary of Economic Projections (known as the dot plot) is that the labor market will remain under pressure. The forecast for a slightly higher unemployment rate is justified by:

- A tighter ratio of jobs available to unemployed individuals

- The average of initial jobless claims is up about 3,000 individuals from the first week of January through the first week of December

The impetus for the votes against cutting interest rates center around concerns of inflation remaining well above the Fed’s target average of 2%. The core-PCE inflation index, the Fed’s preferred inflation measure, remained mostly flat in September at 2.82%. The median FOMC estimate for the end of 2025 is about 3%, indicating some additional inflationary pressures on the economy.

The tension between sticky inflation and a weaker labor market will likely prevent significant changes to the federal funds rate near term. For example, the FOMC’s median dot plot estimate for 2026 is 3.4%, only slightly below current rates. The CME market currently estimates slightly lower rates than the FOMC, but still only 0.5% below current rates.

My expectation is that the federal funds rate will settle a little above 3% for most of 2026.

What Does This Mean for Farmers’ Short-Term Debt?

The recent cut to the federal funds rate should slightly reduce the borrowing cost for farmers with loans that are tied to a variable-interest rate product. As the industry enters the renewal season, variable-rate and other short-term products are likely to be around 0.75% lower than a year before and about 1.70% below the recent peak. While not a major savings in the total expense column of a farm’s balance sheet, it is a savings during a period of high input costs.

I do not expect many cuts to the federal funds rate in 2026 unless an unforeseen event significantly weakens the labor market. My expectation is that the federal funds rate will settle a little above 3% for most of 2026. Therefore, farmers should not expect significant savings on interest expenses on their cash flow projections. The focus should continue to be on making current interest rates, and costs, work for their operation.

Little Movement in Long-Term Loan Interest Rates

The expectation for long-term interest rates is more nuanced. Long-term interest rates are driven only in part by the expected path of the Fed’s rates. Other factors such as fiscal policy discipline, expectations of inflation and economic growth, and the Fed’s balance sheet play a larger role in determining long-term interest rates.

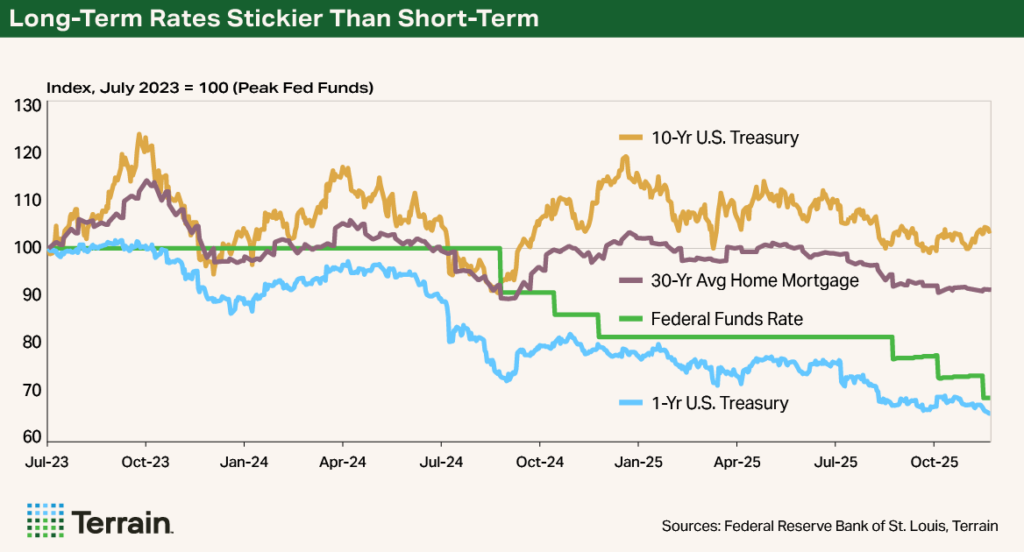

For example, even though the Fed has significantly cut the federal funds rate since the initial peak in July 2023, longer-term rates such as the 10-year U.S. Treasury or the 30-year mortgage have fallen only slightly.

My current expectation for 2026 is that economic growth and inflation improve slightly.

My current expectation for 2026 is that economic growth and inflation improve slightly. The Fed has also stopped the reduction in its balance sheet, after trimming more than $2.38 trillion in assets, and will purchase a limited amount of short-term products for system liquidity.

I expect mostly flat to slightly lower long-term rates in 2026.

These factors represent a tailwind that could help lower long-term rates. However, fiscal policy concerns over rising debt-to-GDP levels present a significant headwind to lower long-term rates.

I expect mostly flat to slightly lower long-term rates in 2026. For farmers looking to place long-term debt, it is important to make sure that cash flows work with today’s rates and not bank on further rate reductions.

Additionally, farmers should work closely with their Farm Credit partner to carefully consider the cost of optionality should interest rates unexpectedly decline significantly. The cost of optionality may be small and provide some future savings if rates move quicker than expected.

With all the various management needs of your operation – input costs, equipment repairs, labor and livestock expenses – you need a line of credit that can keep up. An operating line of credit from Farm Credit Services of America has convenience, savings and flexibility built in, so you can meet each season’s needs without slowing down.

Terrain™ content is an exclusive offering of AgCountry Farm Credit Services, Farm Credit Services of America, Frontier Farm Credit, and American AgCredit.

While the information contained in this site is accurate to the best of our knowledge, it is presented “as is,” with no guarantee of completeness, accuracy, or timeliness, and without warranty of any kind, express or implied. None of the contents on this site should be considered to constitute investment, legal, accounting, tax, or other advice of any kind. In no event will Terrain or its affiliated Associations and their respective agents and employees be liable to you or anyone else for any decision made or action taken in reliance on the information in this site.