Frontier Farm Credit and Farm Credit Services of America (FCSAmerica) are co-sponsoring a five-part webinar series, Two Economists and a Lender. The third webinar, featuring Agriculture Economic Insights (AEI) co-founders David Widmar and Brent Gloy and Melissa Elstermeier, a financial officer with FCSAmerica, focused on ARC vs. PLC ahead of Farm Program signup. Register for our next free webinar, Working Capital, on September 26 at 12:30 p.m. CDT.

Below are highlights from their discussion, as well as a link to the full webinar.

Farm Program signup for the 2019 and 2020 crop years begins September 3. But producers have until March 15, 2020, to choose between ARC (revenue coverage) and PLC (price coverage). The experts advised taking time to fully understand how each impacts your operation before making a final decision.

“There is no rush,” David Widmar said. “By the time we get into 2020, you will know a lot more about your 2019 yields and price prospects.”

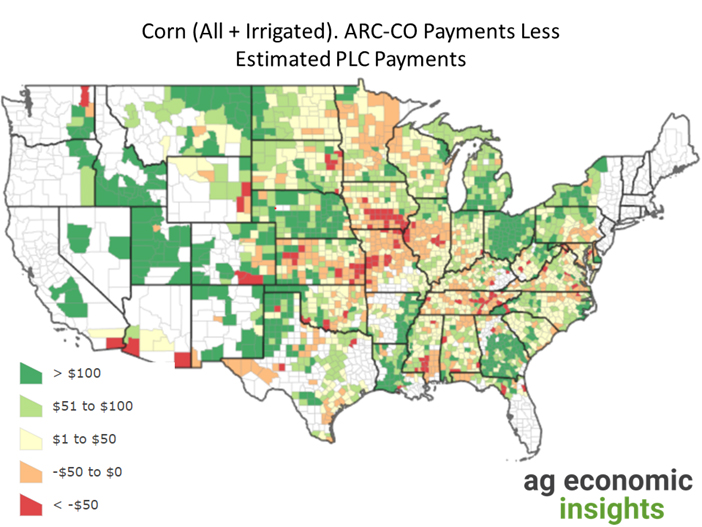

Current economic conditions are important to understanding how the features of ARC and PLC will impact your operation. The economists shared a map of counties where ARC payments over the life of the 2014 farm bill were higher or lower than PLC payments. In most of Nebraska, corn ARC performed better than PLC by more than $50 to $100 an acre, Widmar pointed out. “In southern Iowa, however, it performed about $50/acre worse than PLC.” In general, PLC worked better for wheat, he added.

Based on several factors, including tweaks in the 2018 farm bill and several years of poor returns, the Congressional Budget Office believes the pendulum generally has swung from favoring ARC to favoring PLC. USDA’s August projection that 2019 corn will average $3.60 implies a PLC payment of 10 cents per bushel.

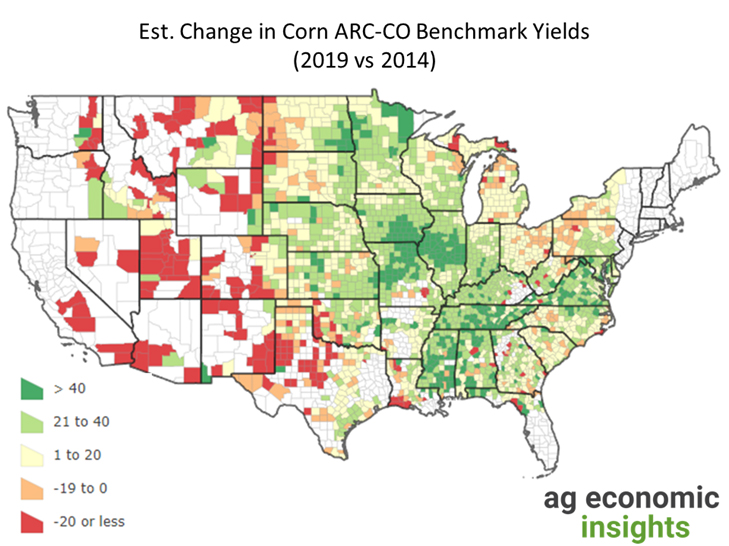

However, Widmar cautioned, two bad strategies are repeating your 2014 decision and automatically picking PLC. One reason for this: The change in ARC benchmark yields. Many counties saw corn yields improve by 21 to 40 bu./acre and a substantial number saw their averages rise by more than 40 bu./acre under the current Farm Program.

“That will be a big benefit for some counties that had outstanding yields the past few years,” Brent Gloy said. (See map.) The same is true for soybeans.

“So, particularly if your yield in 2019 is really bad, ARC may be a better choice because of its higher yield guarantee,“ Gloy said.

“Given tight margins, it’s critical we all make good decisions and not leave dollars on the table,” Gloy said. “Use all the risk management options you have and view these government programs as a supplement.”

Watch the full half-hour webinar below.