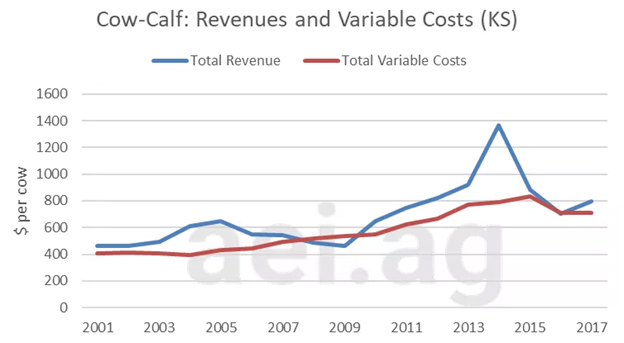

After the spike in profits to $575/cow in 2014, the cow-calf sector has been faced with much tighter margins for several years now – and next year promises to bring more of the same. That’s the bottom line from David Widmar, an agricultural economist with ageconomists.com and Purdue University, who will be the keynote speaker at GrowingOn® 2019 at five locations in Kansas in December. He points to revenues declining faster than production costs as the cause of the squeeze.

However, he says, “it is worth pointing out that total revenue remains historically high. Prior to 2009, revenues only occasionally reached $600/head, but they have remained above that level since then.”

Unfortunately, costs have remained above $600/head as well. (See chart below, based on Kansas Farm Management Association (KFMA) data.)

As producers seek to maintain black ink, paying close attention to feed and pasture costs is critical, Widmar says. Combined, these costs account for two-thirds of total variable costs and about half of all costs.

KFMA records for 2017 also indicate the difference in feed cost between the top third and bottom third of producers based on a margin of 30 percent for calves and almost 40 percent for feeder cattle, with the higher-margin third paying $89/head less per calf and almost $163 less per feeder.

The difference in pasture rent is less, with the higher-margin producers paying 10 percent more per calf and 20 percent more per feeder. In other words, they likely have better-quality pastures.

Some other costs have even larger percentage differences between top-third and bottom-third margins, but they are less important on the whole due to their smaller role in overall costs.

Overall, the high-margin producers using KFMA had net returns $334 per head higher than the low-margin producers.

Widmar will share his outlook for cattle and swine production, prices and margins at Frontier Farm Credit’s free GrowingOn meetings, December 3-7. Click for locations and times and to register.