Revenue insurance isn’t just about growing a crop, it’s about selling a crop.

If you aren’t taking advantage of the peace of mind Revenue Protection (RP) affords for forward pricing, you may be leaving money on the table. In the current price environment, pennies, nickels and dimes can mean the difference between a financially successful year and one that burns equity.

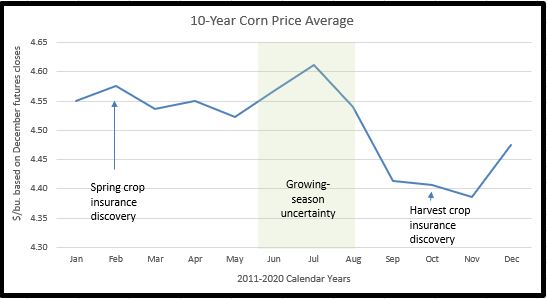

Most years, prices rally on production uncertainty during the growing season, as illustrated by the corn chart below. On average, the best pricing opportunities (green-shaded area) for corn and soybeans are seen during the growing season.

There are many ways to look at crop pricing opportunities but our purpose here is not to address when to market your crop. We’ll discuss seasonal probabilities just enough to set the stage for a discussion of the possible benefits crop insurance can bring to the marketing table.

The chart above shows the 10-year monthly average closing price for December corn futures. As you can see, July has offered the highest average price, followed by the months on either side. Once the crop is made and harvest is coming, prices have averaged about 20¢ less.

What averages don’t show the swings between highs and lows. During this 10-year period, the price difference between high and low average monthly closes in a given year ranged from 83¢ to $3.50/bu.

This is not to imply farmers should try to hit the high with sales. It just points out that you have better odds of above average prices by pricing at least part of your crop on growing season uncertainties than once the crop is made. June, July and August each had the highest average twice in the 10 years, while January, April, May and December were highest one year each. On the other hand, September, October and November never had the highest price average. They each did have the lowest price average several times, however: September, three times, October, once and November, twice.

Also notice that although February wasn’t the highest price month in any year, crop insurance guarantees perform quite well, on average.

How Revenue Insurance Helps

The risk of forward pricing before the crop is harvested in order to capture seasonal price strength is failing to grow enough bushels and being forced to buy replacement bushels to fill the contract – possibly at a higher price.

Here’s how to integrate your revenue insurance and your marketing plan. First, calculate your insured bushels and expected uninsured bushels. For instance, if your APH is 170 bu. and you buy 80% coverage, 136 bu. are covered; 34 bu. are not. Perhaps expected yield is higher than your APH, adding to noninsured bushels. On seasonal price strength, you might hedge or forward contract the 136 bu.

To protect the price on the uninsured bushels, you might consider buying put options because options don’t have any delivery risk. If prices rise, the option simply expires worthless. If they fall, you can either sell the option or exercise it and add the profit to your cash price.

Given RP’s fall price adjustment, in a year when a weather event causes a shortfall and prices rise, your indemnity payment helps cover your contract responsibilities. Suppose a late-season drought dings corn yield but soybean yields plummet; corn price doesn’t respond but soybean price jumps $5/bu. during the fall price discovery period. This is a simplified example that doesn’t consider basis. It is not meant to portray price outlook, nor does it discuss every possible price outcome. It is just meant to illustrate the connection between crop insurance and advance sales.

In the current economic environment, having the right crop insurance is the first step. Knowing your cost of production and formulating a marketing plan is the second. Understanding how the two to work together is critical.