Drawing on his experience as a partner in a dairy and creamery, Dr. David Kohl outlines a planning guide to help producers better understand their operation’s financial position and build a plan for the coming months and years. Producers need to know where they are today to get where they want to go in the future, says Kohl, professor emeritus at Virginia Tech and a presenter at some of our customer education events.

Update your balance sheet. If you are consistent in how and when you capture your assets and liabilities, it is easy to see your operation’s financial progression from one year to the next. At the dairy, Kohl says, the goal was to have an up-to-date balance sheet by January 1 of each year. The management team would compare the resulting income statement against its earlier projections for the year to see how much – and why – the numbers varied. Were the deviations caused by macroeconomics, such as cheaper fuel? Or was it microeconomics at work – perhaps something management did right or wrong?

Develop cash flow projections. Calculate income minus expenses to determine whether your business will cash flow. Take the exercise a step further and use your projections for a baseline from which to develop several what-if scenarios. If corn prices were to fall below $3.50 a bushel, for example, could you pay your bills? This exercise allows you to develop a focused plan so you understand what adjustments might need to be made in your operation.

Review and discuss. After the partners at the dairy finished thinking through their what-ifs, the management team stepped in to critique the budget to identify potential holes. Having another set of eyes is critical to stepping back and considering additional possibilities or alternative ways of looking at potential challenges, Kohl says. If you don’t have a management team, turn to your outside experts, such as a lender, to review your projections. Good lenders will offer thoughtful suggestions and ideas to consider

Commit your goals to writing. This includes business, family and personal goals in one-, three- and five-year increments. Every person involved in running your operation should be asked to complete this exercise. When each person shares his or her goals, it becomes easier to prepare for and make changes in a business.

If you can have your goals articulated, your balance sheet updated and your cash flow planned by Groundhog Day of each year, you will be well-positioned to make sound business decisions and well-prepared for discussions with your lender.

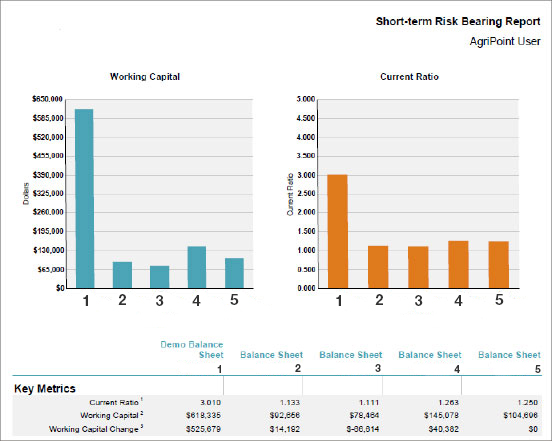

Create balance sheets, cash flows and examine year-over-year trends in your business.

Manage and analyze your financials through AgriPoint®.

Financials, one of the free digital tools available to Frontier Farm Credit customers through AgriPoint®, includes a worksheet with current assets and liabilities, followed by noncurrent assets and liabilities.

As you progress through the form, it automatically calculates your working capital and net worth.

When you are finished, you can save your balance sheet for future use and a click of a button will turn it into a PDF you can file or email. The online tool also runs what-if scenarios on how a purchase — or change in price — would affect your operation.

Access or set up your AgriPoint account.