The November installment of Two Economists and a Lender, a webinar series sponsored by Frontier Farm Credit focused on budgeting for the new growing season.

Below are highlights from their discussion, as well as the full webinar.

With harvest all but done, now is the time to start budgeting for a new growing season. Some costs likely will increase, although modestly, say Dr. Brent Gloy and David Widmar, co-founders of Agricultural Economic Insights. Producers also should factor continued uncertainty into their 2020 planning.

“Budgets are one of the most important management tools,” Gloy says. “But they often are underrated in its role of keeping on top of where you are. Updates and tracking are key to making good decisions.”

Budgets can be used for cash-flow planning, setting marketing goals, risk management, cost control, enterprise analysis and land rental decisions. The economists stress the importance of looking at “economic costs.” This includes out-of-pocket and overhead expenses, as well as opportunity costs.

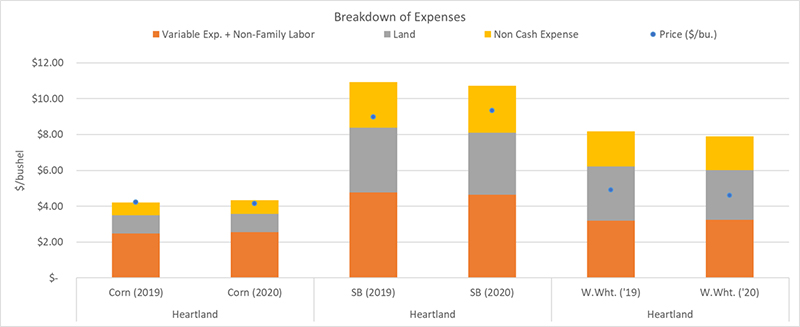

In their 2020 cost projections below, Gloy and Widmar account for land and noncash expenses, such as family labor. Producers need to include family living cost in their budgets if they plan to fund it through their farming operation.

While every operation’s budget will be unique, Gloy and Widmar forecast that on the whole, variable corn costs will be slightly higher in 2020 and soybean costs slightly lower. Variable and total costs for wheat will be comparable to 2019. The economists project fertilizer prices will be a bright spot for what they call the “Prairie Gateway."

Based on harvest-time (2020) futures adjusted for basis, they project a corn price of $4.04; soybeans, $9.36 and wheat, $4.62.

“Don’t be overly alarmed by the fact that corn and soybeans don’t cover non-cash expenses. That is typical,” Gloy says. In fact, with price very near the economic cost, corn looks very promising, he says.

“But wheat’s failure to cover out-of-pocket costs and land explains the reason acreage planted to wheat is falling.”

Once you complete your budget, keep it updated and use it, urged Aaron Raymond, a relationship officer in Lincoln, Nebraska. “If you create it for your loan application then ignore it, it is a useless exercise. Unfortunately, that is what I see most do. But those who do update and use it as the most confident decision makers.”