After the prolonged harvest many producers endured, followed by a scramble to get production reports pulled together, it isn’t surprising if a sigh of relief is the main emotion. But grain in the bin cannot be considered a marketing plan and the job isn’t finished if the grain isn’t priced.

If you don’t have your 2018-crop and a preliminary 2019-crop marketing plan in writing yet, this is a great time to sit down and do it. “Timely marketing of grain was a big delineator of winners and losers in 2018,” noted Tyson Anderson, financial officer, Frontier Farm Credit.

Start with your true and total cost of production, Anderson said, adding that using a computer-based software program is critical. “Accurate accounting makes it easier to create a marketing plan and pull the trigger on sales when the time is right,” he explained.

Once you have calculated your cost of production and know what price you need to be profitable, there are three factors to consider in marketing old-crop production: futures price “carry,” local basis and the cost of grain ownership.

Separating futures from basis presents an opportunity to improve your price received.

Futures carry

Futures carry is the difference between the price of nearby futures and contracts further into the future: March, May and July. In times of large carryover, it is typical for the market to offer carry, to incentivize elevators and farmers to hold the crop off the market. This year was no exception. By late fall, corn futures carry was 25¢-30¢ from December to July – nearly the full cost of carry, and likely to cover the cost of on-farm stored bushels but not farmer-owned bushels stored commercially.

To capture that carry, farmers would have to hedge their bushels by selling futures in the deferred months or initiate a hedge-to-arrive contract. In either case, basis could be set separately, when it improves.

Basis

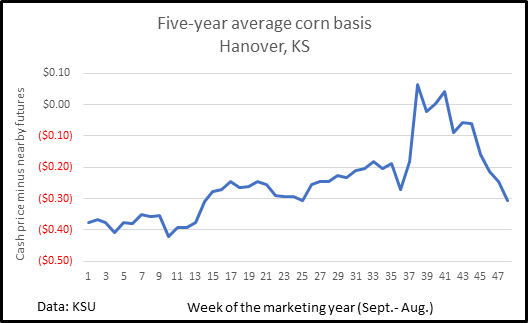

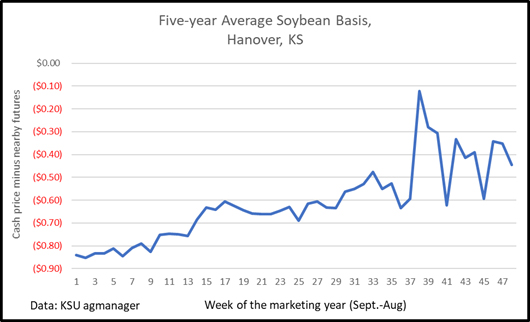

Basis is simply the local cash price minus the nearby futures contract. It reflects local supply/demand and can vary by elevator, co-op, processor or river terminal. Basis typically is weakest (and cash price lowest) at harvest, when supplies are ample, and then improves into the new calendar year. Basis appreciation in January and February tends to stall because large volumes of corn need to be moved out of temporary storage and farmers need to sell to meet winter cash flow needs. Then, during the summer, when stocks are drawn down, basis becomes stronger and more erratic until new-crop harvest begins.

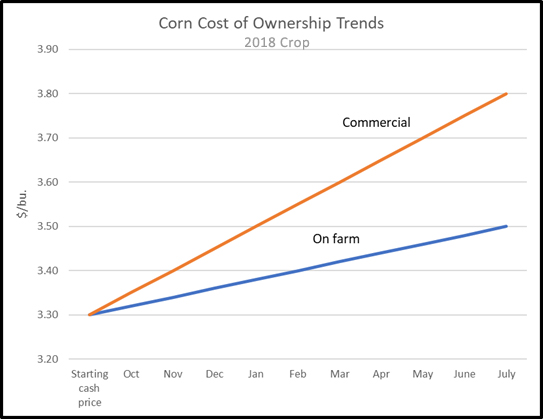

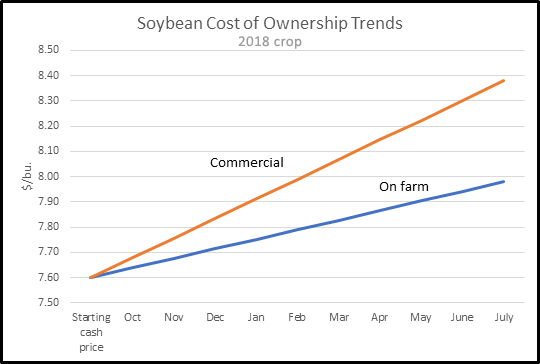

Cost of Storage is not free

Knowing what it costs you to store is critical. Even if your bins are paid off, there is an opportunity cost. The following assumptions are used in the graph below: cash corn at harvest, $3.30/bu. and soybeans, $7.60/bu.; interest at 5% annual percentage rate (APR); on-farm storage cost (bin depreciation, shrink, etc.), 1¢/bu./month; commercial storage charge, 5¢/bu./month. Clearly, these factors will be different based on your circumstances.

As the chart shows, bushels stored on the farm have a better chance of being sold above the cost to hold them than commercially stored bushels.

Note, however, that does not address whether it is possible to sell them for a profit. When the starting price is below cost of production, the ending price could be even more below the cost of production – unless futures prices and/or basis improve.

Spell out your plan

Identify your target price needed to create a positive return. Calculate your cost of ownership for stored bushels and adjust your target price accordingly. Consider creating a line graph like the one above to help assess profitability of storage.

As noted earlier, lock in futures carry – via a HTA contract or futures hedge - when it is available or at least set your target price for a cash sale on seasonal price strength. Historically, corn futures tend to peak seasonally between Easter and mid-July – a little later for soybeans.

Keep track of your local basis at least weekly and lock in that component when it has improved post-harvest.

Consider using a variety of marketing tools, including basis or minimum price contracts so you can eliminate storage costs and lock in the basis if attractive.

And keep in mind that winter cash sales for cash-flow needs mean you will not be able to capture the futures price carry offered in the deferred contracts. That’s why it’s important to plan ahead.