Merchandising unpriced corn and soybeans will likely prove challenging this winter, given USDA’s forecast for ending stocks in August 2018 of 2.44 billion bushels of corn - the highest level in 30 years – and 445 million bushels of soybeans - the highest level in more than a decade.

Other than short covering (commodity funds buying back their short futures positions), expect very few supply or demand surprises that could bring speculative commodity funds back into the futures markets.

Perhaps soybean futures prices could rally this winter with weather uncertainty in South America. A mild La Niña growing season could lead to drier conditions in Argentina and southern Brazil.

Merchandising like your elevator

Many elevators and co-ops have large bunkers of corn stored temporarily outside with covers. How will they make money on those bushels? The answer: Grain merchandisers lock in futures price carry, understand their local basis, and know they have a relatively low cost of grain ownership.

When an elevators or co-op buys corn they plan to store, they sell the underlying futures contracts that represent those bushels. When the bushels are processed or delivered, they buy back those contracted bushels in the same futures contract month. They will often roll their futures contracts forward to maximize futures carry as currently exists in the futures markets.

Futures price carry is defined as the difference between nearby futures and the more distant or deferred months – in this case, May and July as March is the nearby futures contract.

At the end of October 2017, November futures closed at $9.75; March futures, $9.95; May, $10.04 and July, $10.12. So the futures market was offering 37¢/bu. to store beans until July.

To capture this carry, a farmer would have to sell futures in the deferred months (May or July) via a hedge or initiate a hedge-to-arrive (HTA) contract using those same months and make a spring delivery of bushels. It is worth noting that as 2017 came to an end, July beans closed at $9.78 – only 3 cents above the nearby contract price during harvest.

Merchandising like your elevator

In developing a marketing plan for inventory in storage, consider not only the futures price carry but also local basis and your cost of grain ownership.

Basis is simply the local cash price minus the nearby futures contract. It reflects the local supply and demand for soybeans and can vary by processor, river terminal, elevator or co-op facility.

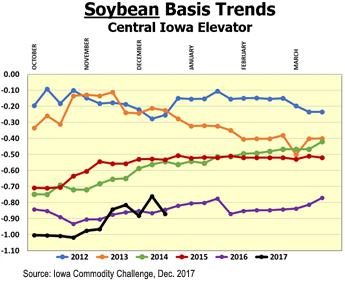

The graph below shows examples of the soybean basis trends at a central Iowa elevator versus the March futures contracts each year since the 2012 crop. The line begins with harvest in October and ends approximately March 1, when the contract goes into delivery.

Note the pattern. The widest basis each year occurred during harvest. The basis trend was much narrower (a smaller negative number) for both the 2012 and 2013 crops when weather concerns had cut ending stocks. In each of the last four years, as U.S. ending stocks have increased, basis has been much wider (a larger negative number).

Note the pattern. The widest basis each year occurred during harvest. The basis trend was much narrower (a smaller negative number) for both the 2012 and 2013 crops when weather concerns had cut ending stocks. In each of the last four years, as U.S. ending stocks have increased, basis has been much wider (a larger negative number).

Since 2014, most of the winter basis appreciation is realized by early January and little or no improvement is seen thereafter. That means that any profit from storage is more likely to come from futures than from basis improvement once the harvest pressure is over.

Cost of ownership

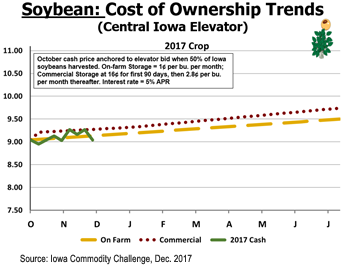

Knowing your cost of ownership for stored bushels is critical. For simplicity, let’s use $9.02/bu. cash soybeans as the harvest time starting point. We’ll assume interest accrues on stored beans at an annual percentage rate (APR) of 5 percent.

Note the on-farm storage line (checked) is estimated at 1 cent per bushel per month while commercial storage line (dots) is 16 cents for the first 90 days and 2.8¢/bu. for each month thereafter. Of course, storage charges vary depending on facilities -- on-farm vs. local elevators vs. co-ops.

Note the on-farm storage line (checked) is estimated at 1 cent per bushel per month while commercial storage line (dots) is 16 cents for the first 90 days and 2.8¢/bu. for each month thereafter. Of course, storage charges vary depending on facilities -- on-farm vs. local elevators vs. co-ops.

In this example, by March, the cost of stored beans rises to $9.50/bu. and by July, almost $9.75.

The dark solid line is the cash price bid at this elevator weekly since harvest. Some years, bushels stored commercially do not provide a positive return above the cost of ownership. On-farm soybeans have a better chance of a positive return, in addition to the ability to shop around for better processor cash bids.

Conclusion

Many farmers are storing record amounts of unpriced grain and face wider-than-normal basis. Expect movement of these bushels to impact cash prices. The availability of South American new-crop soybeans could add pressure to both futures prices and basis well into the spring and summer months.

Cash prices will need to increase enough to provide a profit margin above the cost of your grain ownership. Expect financial pressure this winter on some farmers, especially for those storing a large number of unpriced 2016 as well as 2017 bushels and having cash flow needs.

Calculate your own cost of ownership for stored bushels. Consider creating line graphs like the example provided to assist your marketing plan and as a reminder that storage and interest are not free. Also, track your local basis weekly where you typically deliver bushels to better determine basis trends.

Consider using a variety of marketing tools, including basis or minimum price contracts, so you can eliminate storage costs and lock in the basis, if attractive. You can still participate in a futures price rally when using the deferred contract months (May or July). However, if you make cash sales in the winter months, you will not be able to capture the futures price improvement if it occurs in the deferred futures contracts.