Our economist, Matt Erickson, looks at how supply and demand is shaping grain and protein markets.

Our economist, Matt Erickson, looks at interest rates and how supply and demand is shaping grain and protein markets.

Are Interest Rates Nearing a Peak?

Diesel and Distillate Ending Stocks

U.S. Corn and Soybean Outlook

Cattle and Beef Outlook

Swine and Pork Outlook

Diesel and Distillate Ending Stocks

Summary Points

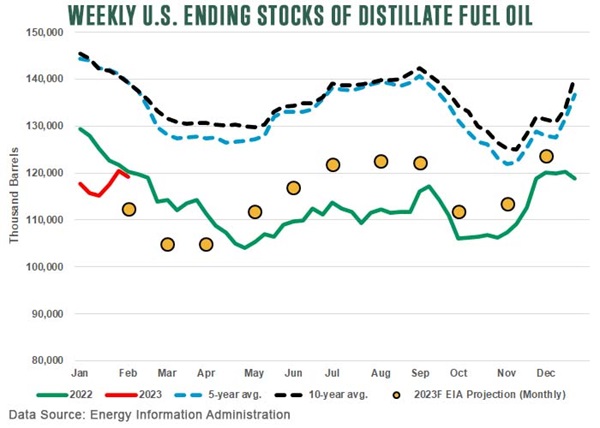

- Weekly U.S. ending stocks of distillate fuel in mid-February dropped to 119 million barrels, 15% below the 10-year seasonal average.

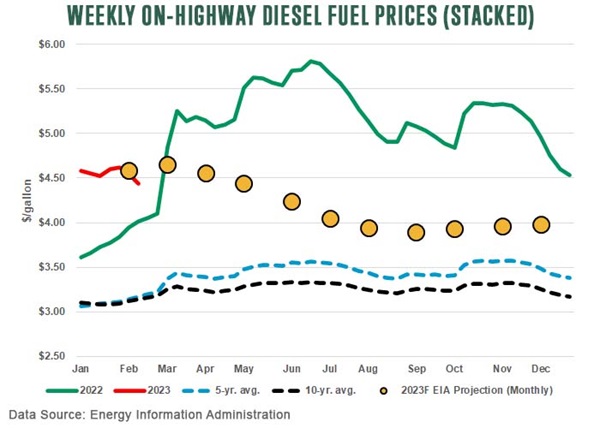

- While demand also was down, a shortage of distillate fuel will continue to exert pressure on diesel fuel prices. The Energy Information Administration (EIA) projects average 2023 diesel prices will run $0.93 per gallon above the 10-year average – $4.23 per gallon vs. the 10-year average of $3.29.

Why This Matters

In November 2022, U.S. ending stocks of distillate fuel were at their lowest level since 1951. Since then, stocks have improved. The weekly U.S. ending stocks in mid-February, referred to above, were similar to 2014 levels.

A relatively warm winter in the United States and lower domestic commercial shipping has reduced demand for diesel. North American intra-continental freight shipments have declined 12% since last August, per the Cass Freight Index. Distillates supplied to the U.S. market as of mid-February were down 10% year-over-year and 4% below the five-year seasonal average.

Lower demand took some pressure off retail diesel prices, which dropped to $4.44 per gallon the second week of February, down from $4.58 at the start of 2023.

While lower demand has benefitted inventory, ending stock levels show minimal cyclical slack. This creates an environment in which a single, significant event could increase demand, which in turn would put pressure on prices.

Bullish events that could affect the fuel market include:

- China lifting COVID-19 travel restrictions. This likely will increase fuel demand.

- Scheduled refinery maintenance at a major facility. Specifically, possible delays in restarting the facility after maintenance.

- European Union (EU) restrictions on Russian refined products. The restrictions began February 5 and are still too recent to know the full impact. However, if the EU ban on Russian crude oil imports is any indicator, the product ban likely will reconfigure trade routes, and the EU will source more refined products from the U.S. and Middle East. Any incremental distillate export increase from the U.S. to support EU would add pressure on U.S. distillate inventories and prices.

The chart above projects distillate fuel ending stocks to remain below 2022 levels through April (yellow dots). But even if stocks begin to rise above 2022 levels, beginning in May, as EIA projects, they remain exceptionally low through 2023 by historical standards. In fact, EIA projects ending stocks will remain about 15% below the 10-year average through the end of the year.

Ending stocks will keep upward pressure on wholesale and retail diesel prices. In turn, higher prices from 2022 into 2023 are expected to slow domestic and global economic growth and diesel fuel prices could

decrease. The average per-gallon price for diesel is projected to be $4.23, down from $5.02 per gallon in 2022.

U.S. Corn and Soybean Outlook

Summary Points

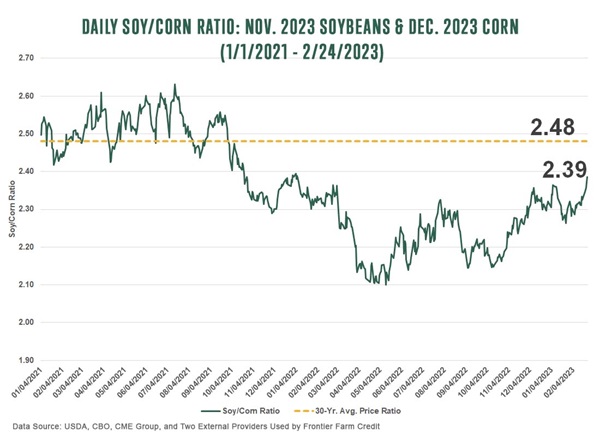

- USDA projects 2023 soybean acres to be similar to 2022 at 87.5 million acres. Corn acres are projected to increase 2.4 million acres to 91 million due to lower input costs and the current soybean-to-corn price ratio favoring corn, as shown in the chart on the right.

- USDA also projects higher production levels – 15.09 billion bushels of corn, 10% more than last year and the second highest on record behind marketing year 2016/17; and a record 4.5 billion bushels of soybeans.

- Higher production is expected to lower corn and soybean prices for the 2023/24 crop. Compared to last year, USDA projects corn prices to drop $1.10 per bushel to $5.60 and soybeans to decline $1.40 to $12.90 per bushel.

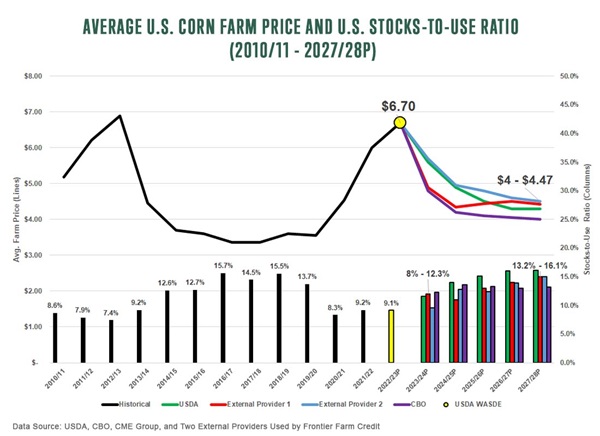

The chart on the left shows five-year corn projections for average farm prices and stocks-to-use levels from four baselines. Supply is projected to outpace use, resulting in a drop in corn prices, from $6.70 per bushel in marketing year 2022/23 to a range of $4 to $4.50 per bushel by marketing year 2027/28.

Why This Matters

The U.S. corn and soybean markets remain relatively tight following last year’s drop in yields. The stocks-to-use ratios stand at 9.1% for corn and 5.2% for soybeans. This, combined with tight global supplies relative to use, are expected to keep commodity prices strong into 2023. But, as the saying goes, “The cure for high prices is high prices.”

If weather conditions are normal, this year’s prices are expected to drive higher plantings and higher production. Both Brazil and the U.S. are projected to produce strong to record corn and soybean crops in 2023. During the next five years, supply is projected to outpace total use for both corn and soybeans (although soybean crush is expected to offset some of the soybean supply increase). Prices could fall over the next three to five years as a result.

USDA’s annual growth rate:

Corn: 2% growth vs. 1% demand growth

Soybeans: 1.3% supply vs. 1.1% demand growth

The chart on the left shows four baseline estimates that are relatively bearish on corn and soybeans over the next 3 to 5 years. However, the range of outcomes is wide based on a long list of uncertainties, current and future. These include the Russia-Ukraine war; the overall condition of the corn and soybean crops in Brazil; Chinese demand; the strength of the U.S. dollar; and weather.

Producers need to maximize positive price gains in today’s market, while also being mindful of potential setbacks and/or opportunities that may occur. It’s important to pay attention to markets and their seasonality trends throughout 2023. If trends and normal weather conditions persist in 2023, pressure on corn and soybean prices will come from record crops in Brazil as well as high yields in the U.S.

Risk management strategies will be key to protecting revenues and margins. Longer term, producers need to ensure their operations are positioned to be profitable in a lower-price environment.

Cattle and Beef Outlook

Summary Points

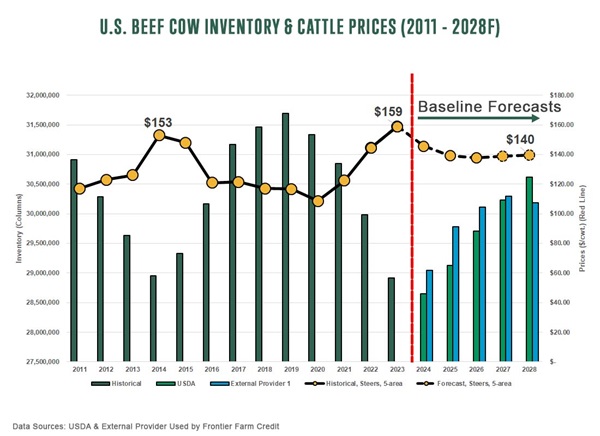

- Beef cow inventory and production are projected to fall through 2024. USDA expects beef cow inventory to decline 3.6% compared to last year and beef production to fall 6.3%. Both could fall an additional 1.3% in 2024.

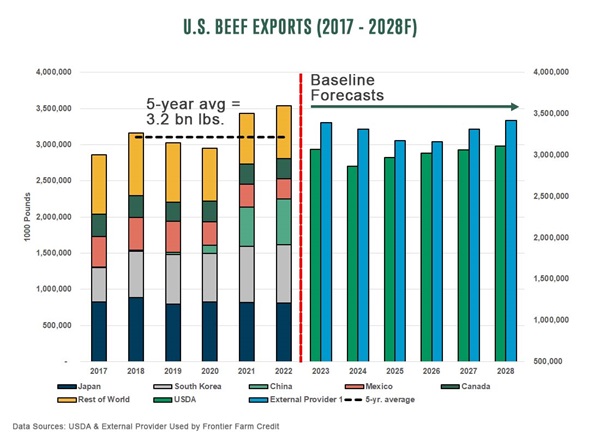

- After setting annual records for both volume and value in 2022, U.S. beef exports could decline due to lower supplies. U.S. exports in 2023 fall about 13% in USDA projections and 5% in projections from an external provider used by Frontier Farm Credit.

Why This Matters

The U.S. beef cow herd numbered 28.9 million head in the January cattle inventory report, the smallest beef cow herd since 1962. Two years of drought and high feed prices contributed to today’s tight inventory and production. Placements and feedlot numbers are expected to decline in 2023. USDA projects higher imports of live cattle this year, possible as many as 2.1 million head, an increase of 31% from 2022.

Last year, U.S. beef exports set annual records for both volume and value in response to higher Chinese demand. Between 2020 and 2022, Chinese imports of U.S. beef increased 430%. On a year-over-year basis, U.S. beef exports also saw broad-based growth in other major markets, including South Korea, the Philippines, Taiwan and Singapore.

The projected decline in U.S. beef exports as a result of limited supplies is expected to last through 2024. Exports are expected to rebound between 2025 and 2026 as producers respond to higher prices and the cattle inventory begins to expand.

However, the magnitude of the current contraction in the cattle and beef sector will be determined to a large degree by feed availability and price. Hay production in 2022 was 112.8 million metric tons, the smallest level since 1959. U.S. hay stocks (as of December 1, 2022) were reported at 71.9 million tons, down 9% from 2021 and the lowest stock level since 1954. Historically low U.S. stocks are likely to keep hay prices elevated in 2023.

While the decline in the U.S. beef herd will reduce overall feed demand, the fact that the U.S. has extremely low hay and forage supplies may result in less-than-expected demand loss for feed grains. How that plays out in 2023 will be of interest for the U.S. beef and feed grains sectors.

U.S. cattle prices are expected to increase more than 10% in 2023 to $159 per hundredweight, up from $144 in 2022. As producers respond to higher prices, the cattle inventory is projected to expand in 2025. As a result, cattle prices are projected to decline through 2026 while still remaining above their 10-year average of $128 per hundredweight.

Swine and Pork Outlook

Summary Points

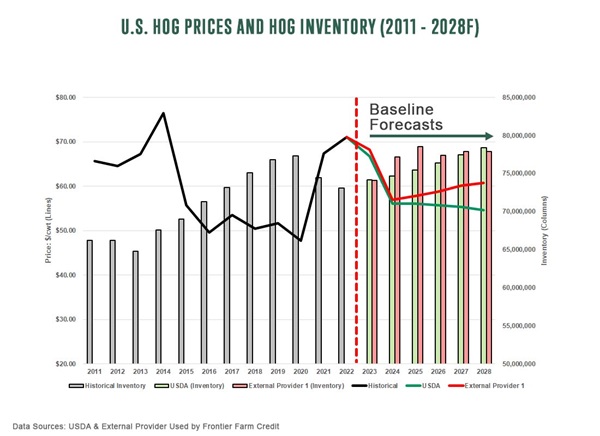

- At more than $71 per hundredweight, hog prices in 2022 were the second highest on record. (This reflects national base price for live-equivalent 51% to 52% lean hogs.) Baseline projections forecast hog prices through 2028 at $58 to $60 per hundredweight for an average of $57.

- U.S. pork exports in 2023 are expected to decline for a fourth consecutive year, primarily due to reduced demand from China. In 2020, China represented 28% of total U.S. pork exports; in 2022, 10%. The large pullback from China can be attributed to the recovery in the Chinese pork sector as well as disruptions in the Chinese economy.

- U.S. hog inventories in 2022 were at their lowest level since 2016. While a very slight uptick is expected in 2023, projections show levels approximately 2% below the 5-year average. Tighter-than-average supplies are expected to keep 2023 hog prices above the 5-year average.

Why This Matters

The December USDA Quarterly Hogs and Pigs Report showed inventory of all hogs and pigs at 73.1 million head, down 2% from 2021 and the lowest level since 2016. Year-over-year, U.S. pork production decreased 2.5% to about 27 billion pounds in 2022. Market uncertainties as a result of California’s Proposition 12, disease pressures from Porcine Reproductive and Respiratory Syndrome (PRRS) and high feed costs remain challenges, and hog inventories are not expected to surpass the current five-year average until 2025. USDA projects commercial pork production to increase 6.8% between 2023 and 2028 – from 27.3 billion pounds to 29.2 billion pounds.

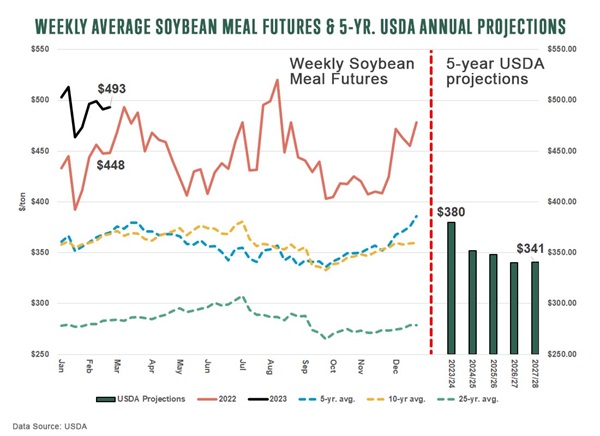

For a closer look at feed costs, the chart on the right shows, as of week-average February 20, 2023, soybean meal futures up 10% year-over-year to $493. During the fourth quarter of 2022, soybean meal futures increased 18% to end the year.

Drought in Argentina, the world’s largest supplier of soybean meal, continues to impact global supplies. Argentina is projected to produce 29 million metric tons in 2022/23 – 4.3% below its 10-year average. USDA puts Argentinian soybean meal exports to the U.S. at 26.2 million metric tons, or 5.2% below the 10-year average if realized.

Prices for soybean meal already are generally higher on a seasonal basis. Demand also is up, largely due to China’s effort to rebuild its domestic hog herd. The result is a bullish sentiment in the soybean meal market. However, domestic soybean crush is expected to rise steadily over the next five years to keep pace with demand, according to USDA. Projections put soybean meal prices at $341 per ton by marketing year 2027/28.

China’s rebuilding of its hog herd also is impacting U.S. exports. In 2022, China imported approximately 70% less U.S. pork and comprised 10% of total U.S. pork exports. However, China’s short- and long-term ability to manage ASF is unclear. If Chinese demand remains relatively stable and a stronger U.S. dollar is realized, growth in U.S. pork exports over the next five years is projected to be relatively flat at an annual average change of 1%. Maintaining and expanding market access for U.S. pork will be critical for the sector moving forward.

Hog prices – the average live price for 51% to 52% lean hogs – in 2022 averaged more than $71 per hundredweight, second highest to only 2014. Tight supplies are expected to support hog prices in 2023 – an average of $67 per hundredweight. As the chart on the left shows, hog prices begin to regress as inventories and production increase but remain near their current five-year average – between $57 and $58 per hundredweight.

However, it should be noted that heightened uncertainty exists within the hog sector. The impact of Proposition 12 alone can end up influencing producer actions toward herd expansion, positively and negatively, and will have a direct impact on the direction of hog prices in the future.