Crops in South America are in various stages and harvest is under way in some regions. We have hit that period of the year when importers typically shift purchases from the northern to the southern hemisphere. With an eye to U.S. agriculture’s southern competitors, we asked Planalytics to share its insights into corn and soybean conditions in Brazil and Argentina. We’ve added some additional information to provide a more complete picture.

Brazil

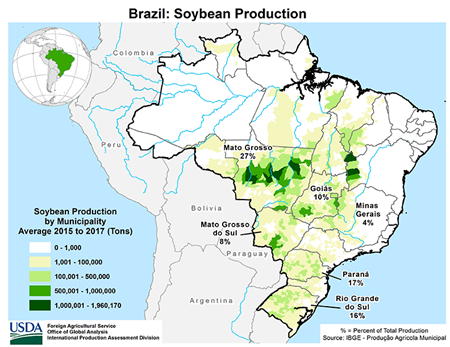

Soybean planting in Parana and Rio Grande do Sul got off to its slowest start in 20 years due to dry soils. But moisture arrived and “much of the growing areas are really starting to catch up,” said Jeffrey Doran, director of specialized support and services for Planalytics.

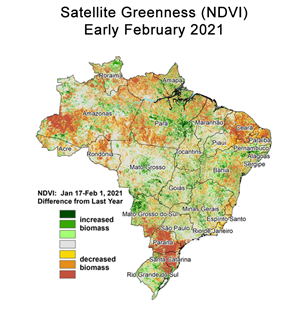

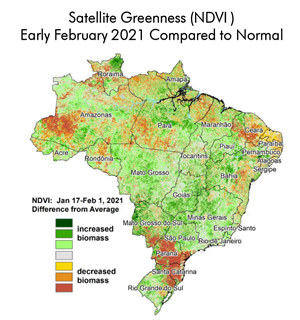

In fact, prospects for the Brazilian soybean crop have swung from great concern at planting to a possible record. Satellite images from TerraMetrics Agriculture show the amount of green vegetation; the image on the left is Brazil compared to last year and, on the right, compared to the 17-year average. Cloud cover reduced the quality of the images, making it appear as if there is less biomass than there really is in the traditional soybean states of Panara and Rio Grand do Sul.

Early planted beans that went into dry ground are seeing some yield reduction, but about 90% of the crop was planted under better conditions and is seeing normal yields, a South American source reported. Also helping to offset lackluster yields in areas of Brazil is the 3% increase in planted bean acres.

Early planted beans that went into dry ground are seeing some yield reduction, but about 90% of the crop was planted under better conditions and is seeing normal yields, a South American source reported. Also helping to offset lackluster yields in areas of Brazil is the 3% increase in planted bean acres.

USDA’s February forecast is for a record 133 mmt crop in Brazil, up 7 mmt from last year, from record harvested acreage of 95.4 million acres, up 5% from last season’s record. But carry-in is down, leading to a slimmer net supply increase of 5 mmt. Official Brazilian estimates are a touch larger.

Harvest and Transport Conditions

Rains are interfering with both harvest and transport, and harvest is likely to continue through May. In the top producing state of Mato Grosso, harvest was only 11% complete in early February, compared with 44% last year and 32% for the five-year average.

Improvements to Brazil’s roads allow easier transport to northern ports and potentially increase the volume shipped through these ports. If both northern and southern ports are used to their full potential, monthly soybean export volume could exceed historic norms and potentially raise total export volume through September compared with 2020.

Coupled with the smaller supply growth forecast for 2021, U.S. producers would face limited competition from Brazilian exports at harvest, similar to the situation observed in the last quarter of 2020.

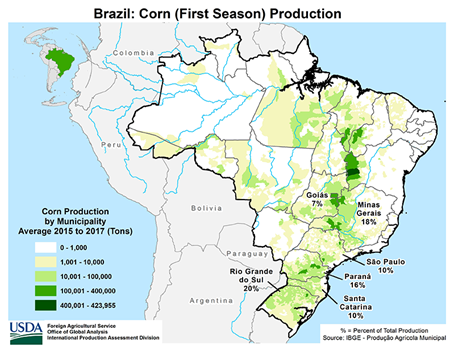

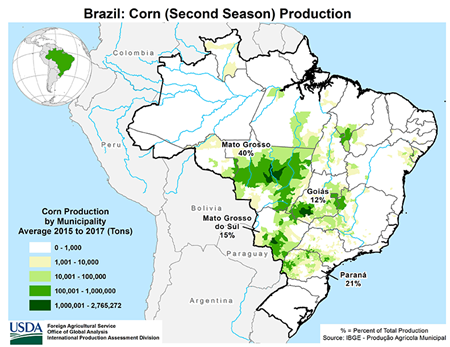

Corn Crop

While Brazil is best known for soybeans, it has substantial acreage in corn as well – either as a primary or second crop. This year’s acreage is pegged at 167 million acres, up 2.7% from last year, and Brazil’s CONAB projects an increase in total corn production of 105.5 mmt, up 3% from last year. USDA puts the Brazilian crop at 109 mmt, up from 102 mmt last year, and exports are expected to jump to 39 mmt from last year’s 35.5 mmt.

This compares with the 2020 U.S. crop of 360.25 mmt and exports of 66 mmt.

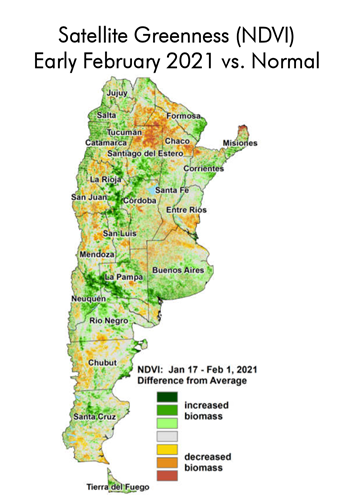

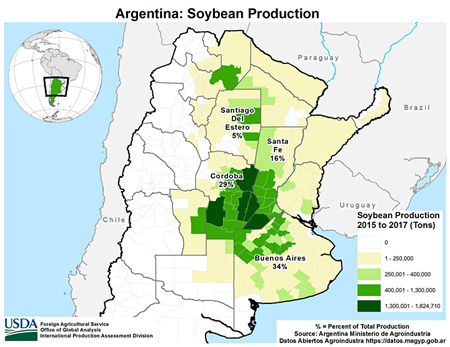

Argentina

The prevailing La Niña conditions reduced rain and soil moisture, which delayed soybean planting in Argentina, the No. 2 South American bean producer. Argentina, however, has not benefitted from rain during the growing season, like neighboring Brazil. The key production area, as seen in satellite images, is much less green than last year and generally less than the average. Doran predicted dryness is likely to continue in key areas.

Even so, USDA projects Argentine soybean production at 51 mmt, up from 48.8 last year. Exports, however, are expected to drop to 7 mmt, down 3 mmt compared to 2020.

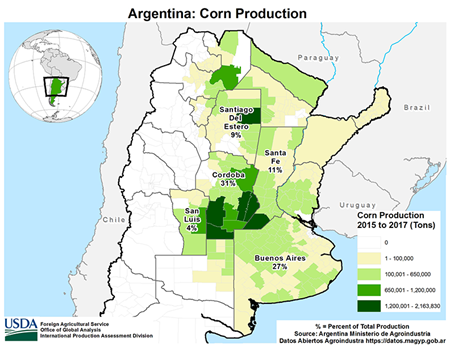

Corn production is pegged at 47.5 mmt, down from 51 last year, according to USDA. Exports will follow suit, dropping from 36 mmt last year to 34 this year.

Bottom Line

Brazil got off to a slow start but enjoyed better-than average weather on the whole. Average corn yield is expected to be 88 bu./acre, about 7% below trend. Soybean yield is estimated at 51 bu./acre, less than a bushel above trend.

There is still some growing season left, especially in Argentina. However, Planalytics says, it will be an uphill battle for Argentina to even come close to trend yields. Current estimates are about 42 bu./acre for soybeans, 5% below trend, and 123 bu. for corn, 3% below trend.