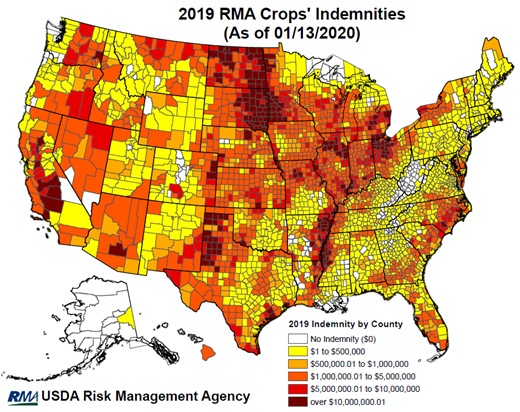

USDA’s crop insurance indemnity payments on 2019 crops, as of January 13, 2020, were $8.1 billion. That is nearly 11% of the $75.3 billion USDA estimated for out-of-pocket costs on seed, pesticides, fertilizer, fuels and oils and electricity.

“Of course, this is not a perfect match and doesn’t consider the additional costs involved in planting a crop, but it does give you an idea how important crop insurance can be in helping producers meet their obligations,” said Tony Jesina, Frontier Farm Credit senior vice president of insurance.

As of January 13, our Frontier Farm Credit crop insurance customers have received $13.3 million in indemnity payments. In the broader plains area, some of the hardest hit operations were in the Dakotas.

“In our service states, almost any kind of weather event can happen during a given growing season – sometimes more than one on the same farm,” Jesina said. “That’s why we continually work to help producers choose the products and options that best meet their risk management needs – and represent farmers when crop insurance comes under fire.”