If you’re trying to make sense of the updated tax laws, you’re not alone. The 2017 tax reform, technically called the Tax Cuts and Jobs Act, presents changes and opportunities.

We are not tax experts and would never recommend that you manage your operation based solely on taxes. But as agriculture’s most valued financial partner, we want to help you reach decisions that assure your business is structured and operating in the best way possible. So we asked Paul Neiffer, CPA with CliftonLarsonAllen LLP, to help us identify key changes in the law that may affect you.

Please use these questions as a tool to seek advice from your own tax professional. We’ve also provided some background on each. Finally, note that many of these changes are not permanent in the law, so be sure to ask how current timelines affect the decisions you make today.

What is the optimum tax bracket for my operation?

Here are the major changes:

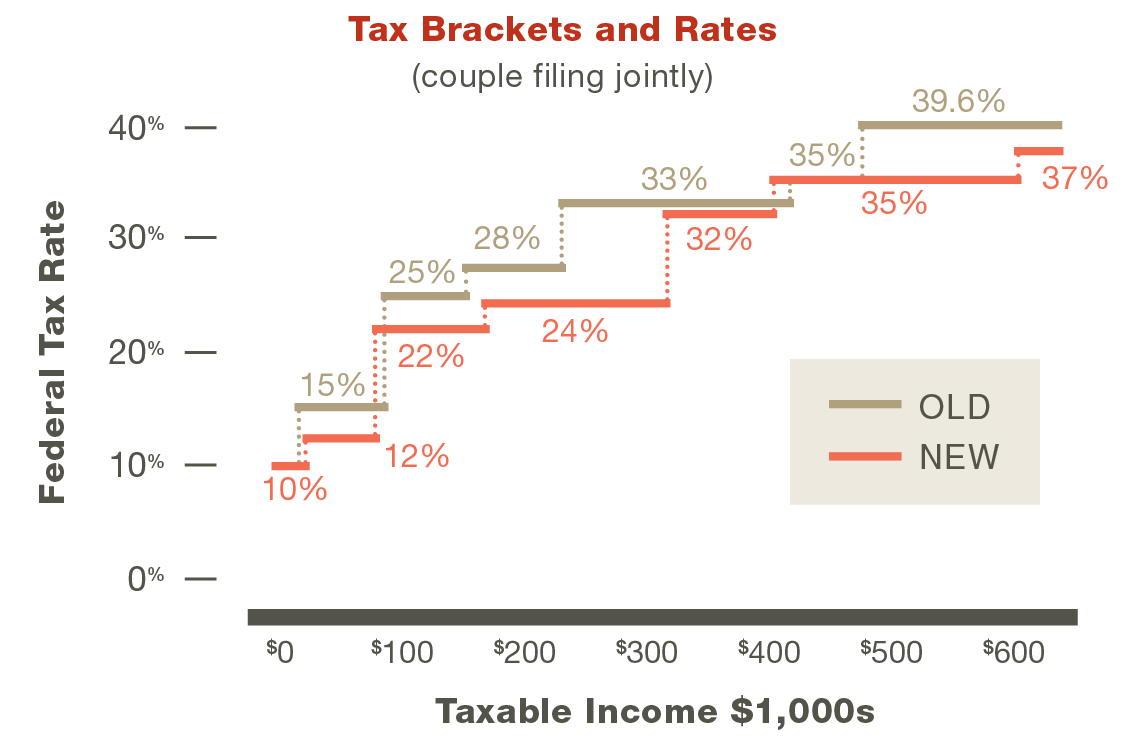

- Individual rates have been reduced and top out at a lower amount, as illustrated in the graph below.

- Deduction of personal state and local income, sales, and real estate taxes is limited to $10,000 on personal tax returns. This limitation does not apply to C corporations.

- The standard deduction increased to $12,000 (individual) and $24,000 (married couples filing jointly).

- The child tax credit doubled to $2,000.

What business structure is right for my operation?

The top corporate tax rate is now a flat 21%. This rate may be an increase for some producers, whose effective corporate tax rate may have been 15%. Their overall tax may be lower, however, based on other new deductions.

How fast should I depreciate assets?

New and used farm assets (other than land) can now be fully depreciated in the year of purchase using 100% bonus depreciation. This includes improvements. So if a farmer purchases a farm with buildings, wells, and fences, those features are now 100% deductible at the time of purchase.

Section 179 is now available up to $1 million.

Is it better to sell or trade my farm equipment?

Section 1031 tax-deferred exchanges now are allowed only for real property (land and buildings). Previously, if a farmer traded a fully-depreciated $40,000 tractor for a $100,000 tractor, the new tractor’s depreciation basis would be the difference ($60,000). Now, you would have to claim $40,000 of income and then be able to fully expense the $100,000 tractor through bonus depreciation or Section 179.

Are there changes to how net operating losses are handled?

There is a $500,000 limit on net business losses. Up to $500,000 of farm business losses can be carried back a maximum of two years or the loss can be carried forward. Losses can be carried forward an unlimited number of years, unlike previous law that limited carry forward to 20 years. Non-farm losses can only be carried forward. Losses can only offset 80% of taxable income on carryback or carryforward. Finally, losses do not reduce self-employment income tax.

What happens to fringe benefits, like health insurance, meals, and employee lodging?

Meals provided to employees are now only 50% deductible, but remain tax-free for employees and 100% deductible for owners of a C corporation. After 2025, there is no deduction for meals.

C corporation employers are still permitted to deduct the value of lodging provided to employees. It remains a tax-free benefit to the employee of a C corporation.

Health insurance for S corporation owners and partners remains deductible.

There are many more questions to ask, but these should get you started. For some additional questions, click for the detailed list.

Check with your Frontier Farm Credit financial officer to learn about the wide range of finance and lease options that fit the needs of your operation.