With the bounty of the 2017 harvest comes the need to review your marketing plans for inventory. There are three factors to consider in marketing old-crop production: futures price carry, local basis and the cost of grain ownership. Separating futures from basis presents an opportunity to improve your price received.

Futures carry

Futures carry is the difference between the price of nearby futures and contracts further into the future: March, May and July. In times of large carryover, it is typical for the market to offer carry, to incentivize elevators and farmers to hold the crop off the market. This year was no exception. By late fall, futures carry was 30¢ from December to July for corn – nearly full carry, and likely to cover the cost of on-farm stored bushels but not bushels stored commercially by farmers.

To capture that carry, farmers would have to hedge their bushels by selling futures in the deferred months or initiate a hedge-to-arrive contract. In either case, basis could be separately, when it improves.

Basis

Basis

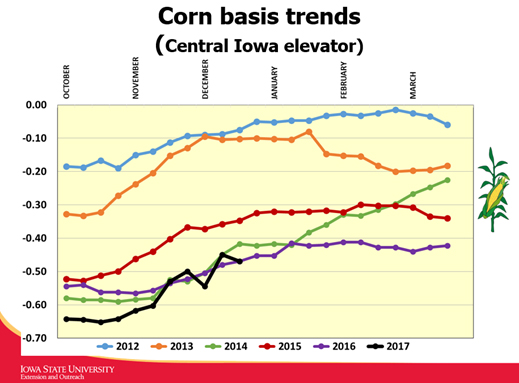

Basis is simply the local cash price minus the nearby futures contract. It reflects local supply/demand and can vary by elevator, co-op, processor or river terminal. Basis typically is weakest (and cash price lowest) at harvest, when supplies are ample. As the chart illustrates, this has been the case – in the face of increasing ending stocks - since 2014, with a 15¢-20¢/bu. improvement seen from late harvest to early January. Basis appreciation in January and February is limited because large volumes of corn need to be moved out of temporary storage and farmers need to sell to meet winter cash flow needs. Note that fall basis was stronger (less negative) in 2012 and 2013, when harvest was smaller and stocks were tighter.

Cost of storage

Cost of storage

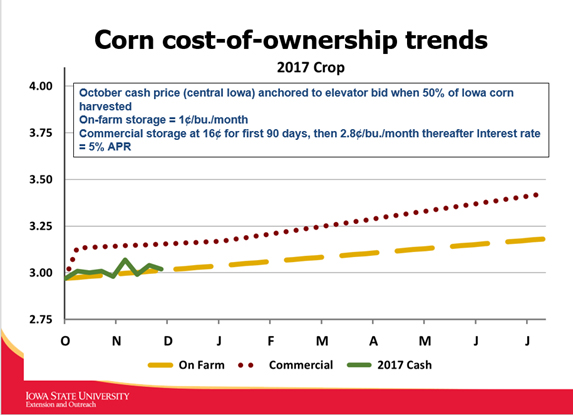

Knowing your cost of ownership of stored bushels is critical. The following assumptions are used for 2017 production in the graph below: cash corn at harvest, $2.97/bu. (price on Oct. 26); interest at 5% annual percentage rate (APR); on-farm storage cost is 1¢/bu.; commercial storage is 16¢ for the first 90 days and 2.8¢ a month thereafter. Clearly, these factors will be different based on your circumstances.

The dark, solid line is the cash price bid at one elevator since harvest. As the chart shows, bushels stored on the farm have a better chance of being sold above the cost of ownership than commercially stored bushels. However, a significant increase in the futures price along with basis appreciation will both likely be needed to see cash prices offered above the cost of ownership.

Spell out your plan

Calculate your own cost of ownership for stored bushels. Consider creating a line graph like the one above to help assess profitability of storage. Lock in futures carry when it is available. Historically, futures tend to peak seasonally between Easter and mid-July – a little later for soybeans.

Keep track of your local basis at least weekly and lock in that component when it has improved post-harvest. Consider using a variety of marketing tools, including basis or minimum price contracts so you can eliminate storage costs and lock in the basis if attractive.

However, if you make cash sales in the winter months, you will not be able to capture the futures price carry offered in the deferred contracts (May or July). As noted earlier, a futures hedge or HTA are ways to lock in the futures component.

Visit the Iowa Commodity Challenge site more information regarding storage and marketing.