As we enter another growing season with grain outlook unchanged, efficiency is paramount. That’s the bottom line carried away by the attendees at GrowingOn® meetings this past winter, here are a few of the key points.

Low- and High-Cost Producers: Income Comparison

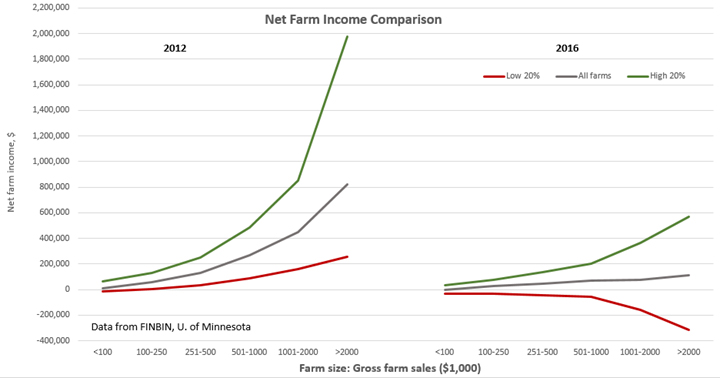

A comparison of net farm income for two years, 2012 versus 2016, was based on records from 8,000 actual U.S. farms using the FinBin program at the University of Minnesota. It clearly demonstrates how results vary by farm size using annual gross farm sales when the top 20 percent of farms are compared with the bottom 20 percent.

In 2012, nearly all farms, regardless of farm size, had positive net farm incomes at near all-time record high levels. The low 20 percent of operations were near or above breakeven in 2012. However, the top 20 percent of farms were netting five to eight times as much as the bottom 20 percent.

The difference was more significant in 2016. The top 20 percent made money, but only about one-fourth to one-half of their 2012 net farm income. Positive returns for the most efficient farms hit $363,000 at $1 million in gross farm sales and more than $566,000 for those above gross farm sales of $2 million. By comparison, the bottom 20 percent of all sizes of farms lost money. The bigger the farm, the worse the picture was in this bottom category; net farm income plummeted to more than $156,000 in the red at $1 million in gross farm sales and to a loss of more than $316,000 at $2 million gross farm sales.

“Size and efficiency amplify the effects of being a low-cost producer,” according to Steven Johnson, the farm management specialist with Iowa State University Extension who helps lead GrowingOn. “That’s why it is important to get better before getting bigger.”

Presenters from Frontier Farm Credit highlighted how changes to various factors affect cost of production and breakeven. “When producers think about reducing costs, saving on inputs is the first thing they think of,” said Tony Jesina, senior vice president – related services. “But some customers are finding significant savings when they examine their machinery line up and identify equipment they don’t get real value from. It’s also important to consider other sources of income and possibly benefits such as health insurance, a major expense for many farm families.”

Frontier Farm Credit also highlighted how Revenue Protection (RP) crop insurance buffers losses and preserves working capital when crop revenue drops below the guarantee. “This can be as important as getting your unit cost of production down,” Jesina said.

Traits of Top Producers

Top producers are proactive, making incremental improvements, lowering cash rent, reducing input costs, keeping family living expenses at modest levels, employing sound financial management and using a “systems approach,” Johnson said. Capturing additional revenue through higher crop prices by utilizing a sound marketing plan is a great way to improve the bottom line since it does not risk lowering yields the way cutting inputs might.

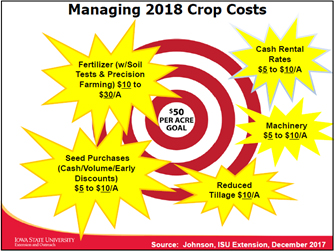

The illustration below depicts some of the savings Johnson called out in his presentation. While the exact numbers will vary by operation and geography, the point is to set a target appropriate to your operation and to seek improvement in each area.

Johnson built on the Marty Merchandiser case study from GrowingOn 2017, showing the steps Marty has taken on his Iowa farm to improve his finances at a time when his net worth and working capital have slipped due to lower land values and a purchase of an adjoining 80 acres at $8,000/acre. Marty has actively managed crop costs and family living expenses, reducing his budgeted cost of production to $3.43 for corn and $9.11 for soybeans. Larger actual yields lowered those breakevens to $3.32 and $8.47, respectively.

Johnson built on the Marty Merchandiser case study from GrowingOn 2017, showing the steps Marty has taken on his Iowa farm to improve his finances at a time when his net worth and working capital have slipped due to lower land values and a purchase of an adjoining 80 acres at $8,000/acre. Marty has actively managed crop costs and family living expenses, reducing his budgeted cost of production to $3.43 for corn and $9.11 for soybeans. Larger actual yields lowered those breakevens to $3.32 and $8.47, respectively.

Marty used 85 percent RP to underpin his pre-harvest hedges and hedged-to-arrive contracts to local ethanol plants. With scale-in incremental sales, Marty’s projected cash corn price was $3.96/bu. on 70 percent of his APH bushels, guaranteeing revenue of $619/acre on winter deliveries. He stored remaining bushels, planning to wait for basis to narrow and to use a variety of marketing tools to capture higher futures prices in late winter and spring.

The result: His operation remains profitable, with $85,000 net income estimated for 2017.

Johnson advised attendees to focus on improving both old- and new-crop marketing. Pre-harvest market on weather rallies in the late winter and especially the spring months. For bushels stored unpriced beyond harvest, understanding your basis trends, futures carry and your cost of ownership can pay off in several ways, Johnson said. Limit commercial storage costs and don’t store longer on-farm than the market will justify. Separate basis from the futures price to improve your net revenue by as much as 20¢/bu. on corn and 50¢/bu. on soybeans, depending on local cash bids.

GrowingOn is one of the opportunities the Association offers customers to learn how to manage the financial and business needs of today’s agricultural operations. Find more resources and information at frontierfarmcredit.com. Click to view the association and Johnson’s presentations and videos.