Frontier Farm Credit and Farm Credit Services of America (FCSAmerica) are co-sponsoring a webinar series, Two Economists and a Lender. This webinar, featuring Agriculture Economic Insights (AEI) co-founders David Widmar and Brent Gloy and Jason Gates, a relationship officer in Cedar Falls, Iowa, focused on machinery investment. Register for our next free webinar, Budgeting and Getting Ready for 2020, on Thursday, November 21 at 12:30 p.m. CDT.

Below are highlights from their discussion, as well as the full webinar.

Do you know your machinery expenses for 2019? There are a number of ways to arrive at this cost. You might, for example, cite the depreciation deduction on your tax return. Or maybe you use the principal payment on your equipment loan or your lease payment to calculate it. Any and all of these are relevant. But none tells the whole story.

Gloy shared the DIRTI approach to calculating machinery expense:

- Depreciation (but economic, reflecting the expected life, not your tax claim)

- Interest

- Repairs

- Taxes

- Insurance

- Custom hire (expenditure on hired work netted against any income from custom work)

Depreciation, repairs and custom are particularly useful for tracking and understanding your costs, said Gloy. “But we recommend using depreciation that reflects its life being used up. If you depreciate the whole purchase in the first year, that would be misleading in this context.”

Every farm is different

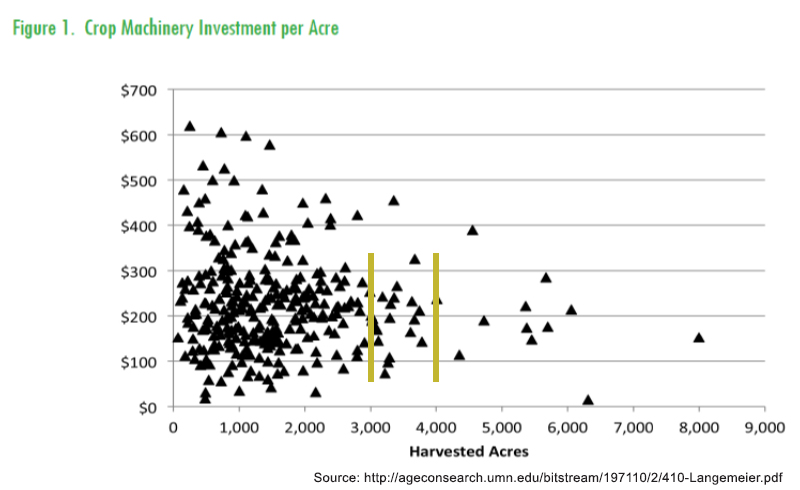

The economists pointed out the wide variability in per-acre cost. Based on one set of farm business management records, farms in the 1,000-acre range have investments ranging from $50/acre to more than $600/acre. In the 3,000- to 4,000-acre range, investments generally are between $100 and $300 per acre. (See chart.)

“One way we like to look at machinery expense is as a percent of gross revenue,” Gloy explained. “Twenty-five percent or lower is a good goal. At 25% to 30%, you may want to approach new investments with caution and over 30%, you are devoting a huge portion of your gross income to this category."

“Keep in mind that variable costs such as inputs typically account for half of gross revenue. If an added 30% goes toward machinery, that doesn’t leave much for other expenses or family living.”

Resource deployment

Once a producer has a handle on machinery costs, he or she can begin to develop a capital expenditure plan: What will be replaced in 2020, in three years, in five years and how will these investments be funded? What about other capital expenditures, such as irrigation rigs or grain bins?

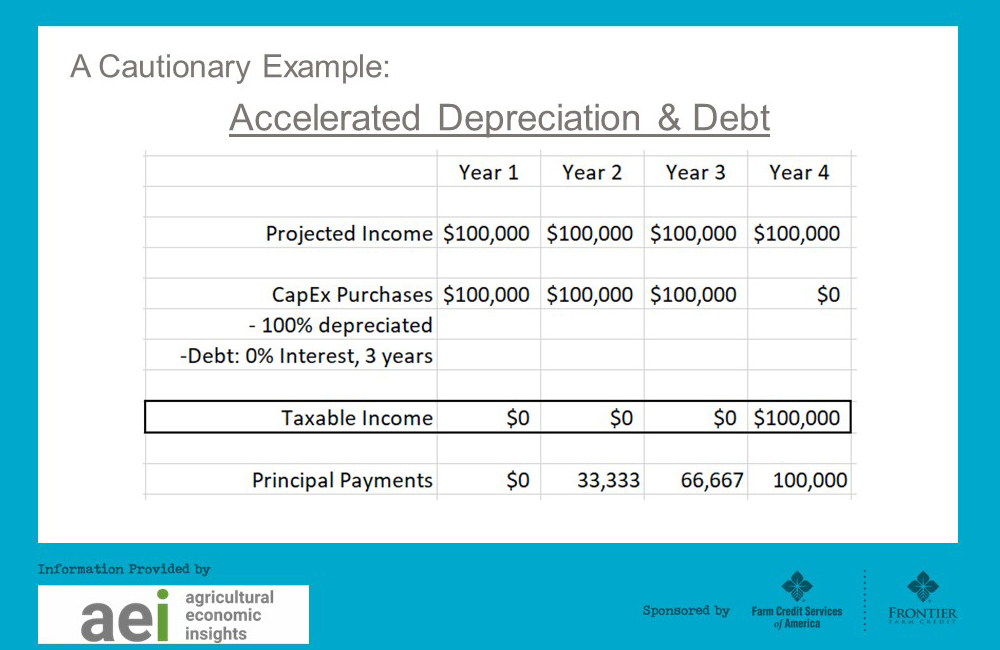

Widmar cautioned against using machinery to defer income tax by financing purchases and using accelerated depreciation year after year. This can have a snowball effect. Fully depreciating capital purchases while also using debt financing means future earnings will be needed to make those principal payments. This can have a compounding impact over multiple years. The table below from AEI illustrates this impact. By year four, in this example, the farm’s entire income is needed for principal payments.

“This is an extreme case, where the farmer is making purchases in multiple years to eliminate taxable income, but it points out how you should consider the implications of a purchase several years out,” Gates said.

Red flag statements

Gates encourages producers to both dig into the economics of their farm and evaluate their objectives before making a machine purchase. A red flag should go up, he says, if your motivation can be summarized with any of the following statements:

- I have a tax issue.

- That machine has a repair that will take too long (or cost too much) to fix.

- My neighbor / friend / other just bought one.

- The dealer has one on the lot.